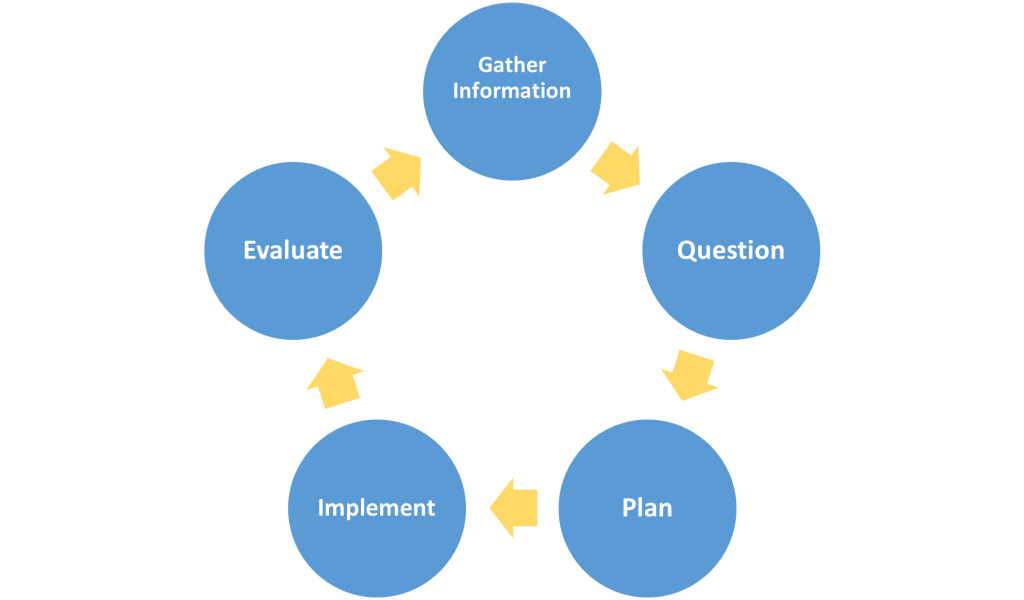

Financial Planning Process

1. Gathering Information

This process is also known as a discovery meeting. We gather details of clients’ status, goals, objectives, financial situations and further financial and personal details into insurances and family commitments to better understand the clients’ financial position and risk tolerance. This information is gathered during the initial meeting and possibly at any ongoing meetings or via email if any information is unavailable at the time (see below).

2. Question

This stage is a continuation from the first step, we may require or ask further question to help ensure we provide you with the best possible solution to your financial wellbeing. For example, you may only want to invest into socially responsible investments.

3. Plan

A tailored financial plan is provided to the client based on the information provided and obtained. The plan considers your personal and financial circumstance.

4. Implementation

Should a client agree to the plan or Statement of Advice (SoA), we will implement the advice. A letter of completion will be provided once it is fully implemented.

5. Evaluate

As a client’s circumstances and financial position changes, we need to evaluate the situation. As part of the financial planning process, we re-evaluate the client’s position and circumstances to ensure it is aligned to their goals and objectives.